Life Insurance in and around Crossville

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

No one likes to contemplate death. But taking the time now to plan a life insurance policy with State Farm is a way to extend care to your family if you die.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Wondering If You're Too Young For Life Insurance?

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less debilitating. Life insurance provides financial support when it’s needed most. Coverage from State Farm gives time to recover without worrying about expenses like rent payments, retirement contributions or ongoing expenses. You can work with State Farm Agent Rob Slone to express love for your partner with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

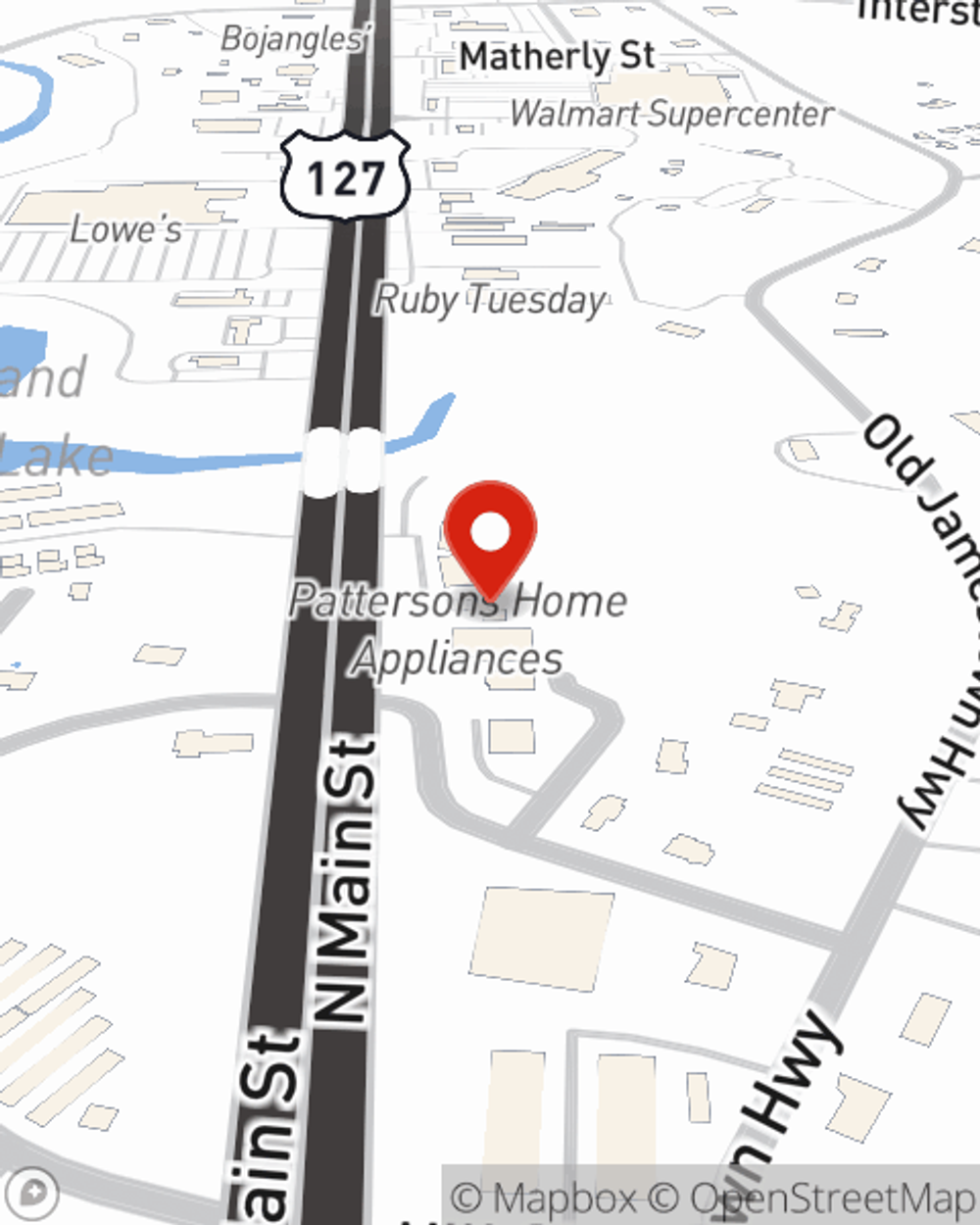

If you're looking for dependable insurance and responsible service, you're in the right place. Talk to State Farm agent Rob Slone now to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Rob at (931) 484-6249 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.